The Buzz on Part A

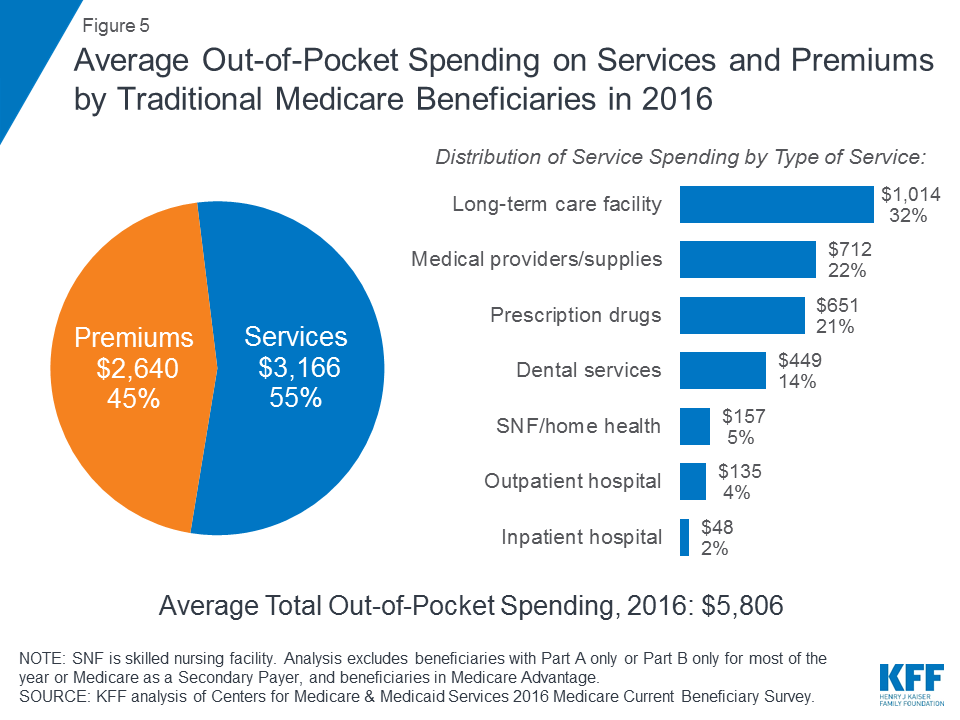

Medicare was never intended to pay 100% of medical expenses. Its purpose is to assist pay a part of medical expenditures. Medicare recipients additionally pay a section of their medical costs, that includes deductibles, copayments, and also services not covered by Medicare. The amounts of deductibles and copayments change at the beginning of each year.

Doctors and also various other companies who accept job consent to accept the Medicare-approved quantity for a service. Carriers who do not approve job might bill you a 15% surcharge. You would be accountable for paying the additional charge (or limiting fee) in addition to any copayments. For that reason, you should constantly ask a supplier to accept the job.

You need to take Medicare Part A when you are qualified. Nevertheless, some people may not want to get Medicare Part B (Medical Insurance Coverage) when they end up being eligible. You can delay enrollment in Medicare Component B without charge if you fit one of the complying with groups. If you transform 65, continue to work, and are covered by a company group health insurance plan, you might want to delay signing up in Medicare Part B.

If you transform 65 as well as are covered under your working partner's employer group health insurance, you might wish to postpone signing up in Medicare Component B. Note: Group health insurance plan of companies with 20 or more staff members need to offer spouses of active workers the very same wellness advantages regardless of age or health status.

Not known Facts About Part A

You will not be enrolling late, so you will not have any kind of charge. If you pick protection under the company group health insurance plan and also are still working, Medicare will be the "second payer," which implies the company strategy pays first. If the employer group health insurance plan does not pay all the person's expenditures, Medicare might pay the entire equilibrium, a section, or nothing.

If you have severe pain, an injury, or an abrupt illness that you believe may cause your health and wellness severe danger without prompt treatment, you have the right to get emergency situation treatment. You never ever require previous approval for emergency care, and also you might obtain emergency care anywhere in the USA (Part D). https://www.wantedly.com/id/csmithmed22.

You should request this info. If you inquire on exactly how a Medicare health insurance plan pays its doctors, after that the plan should provide it to you in writing (https://csmithmed22.blogspot.com/2022/09/the-best-strategy-to-use-for-part-d.html). You also have a right to know whether your doctor has a monetary passion in a wellness treatment center given that it can influence the clinical guidance she or he offers you.

The Only Guide to Part D

The right to information concerning what is covered and also just how much you need to pay. The right to pick a women's health and wellness expert. The right, look these up if you have a complex or significant medical problem, to obtain a treatment plan that includes straight accessibility to professionals.

Benefit plans tend to constrict recipients to a restricted carrier network, as well as coverage for specific solutions might not be as durable as though with Initial Medicare plus additional (Medigap and stand-alone Part D) coverage. Advantage plans, including the expense for Medicare Component B, additionally tend to be much less expensive than Original Medicare plus a Medigap strategy plus a Part D strategy.

Where these strategies are offered, it's usual to see them decrease a person's Component B Social Safety and security costs deduction by $30 to $70 each month, although the costs refunds vary from just 10 cents per month to as high as the full price of the Component B costs.

In that instance, the giveback rebate will be attributed to the Social Safety examine to counter the quantity that's subtracted for Part B. But some Medicare recipients spend for their Component B protection directly. If those beneficiaries enroll in an Advantage plan that has a giveback refund, the quantity of the discount will certainly be reviewed the Part B invoice that they receive.

See This Report about Part C

SNPs are required to cover prescriptions. PFFS strategies in some cases cover prescriptions, however if you have one that doesn't, you can supplement it with a Medicare Part D plan. MSAs do not include prescription coverage, but you can get a Component D plan to supplement your MSA plan. Although Advantage enrollees have legal rights and also protections under Medicare guidelines, the services offered and the fees charged by private insurance companies differ extensively.

Benefit plans can bill monthly costs along with the Part B premium, although 59% of 2022 Medicare Advantage intends with incorporated Component D insurance coverage are "no premium" strategies. This means that beneficiaries just pay the Component B premium (and also possibly less than the typical quantity, if they pick a strategy with the giveback refund benefit defined above).

This average includes zero-premium strategies and Medicare Benefit intends that do not include Component D protection if we only look at strategies that do have premiums and also that do consist of Part D protection, the average costs is higher. Some Advantage strategies have deductibles, others do not. However all Medicare Benefit plans have to presently restrict in-network maximum out-of-pocket (not counting prescriptions) to no greater than $7,550.

PFFS plans sometimes cover prescriptions, however if you have one that does not, you can supplement it with a Medicare Component D plan. Also though Benefit enrollees have rights and protections under Medicare guidelines, the solutions offered as well as the fees billed by private insurance firms vary widely.

Medicare Supplement Plan Can Be Fun For Anyone

Benefit strategies can bill monthly premiums in enhancement to the Component B costs, although 59% of 2022 Medicare Benefit prepares with incorporated Component D insurance coverage are "absolutely no costs" strategies. This means that beneficiaries only pay the Part B premium (as well as potentially less than the standard quantity, if they pick a strategy with the giveback refund advantage explained above).

This typical includes zero-premium plans and Medicare Benefit plans that don't include Part D coverage if we only look at plans that do have costs which do consist of Component D protection, the typical premium is higher. Some Advantage strategies have deductibles, others do not. All Medicare Benefit strategies must currently limit in-network optimum out-of-pocket (not counting prescriptions) to no more than $7,550.

Comments on “Unknown Facts About Part C”